For Financial Services 4.0 and Limitless Possibilities!

Capitalize on data, wow your customers, and establish new revenue streams & solid partnerships!

Request a DemoWhat Is Blinq Open Banking?

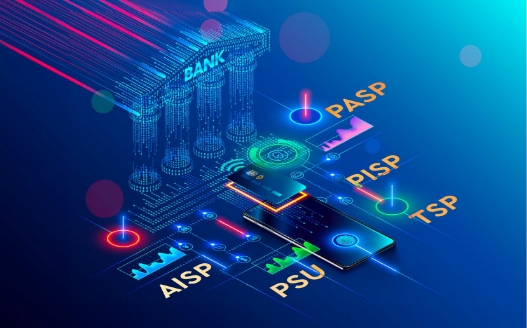

End-to-end OpenID certified open banking platform, ensuring out-of-the-box regulatory compliance, lighting speed exchange of data and services, slashing go-to-market times with extreme agility in proposition offering.

Features

Onboarding Portal

Fast track 3 rd party onboarding with capabilities that ease registration and give stellar developer experience accelerating your product adoption.

End-user Consent Management

Secure authorization and authentication workflow leveraging existing Strong Customer Authentication (SCA) capabilities giving users native Identity and Access Management (IAM) experience at fraction of the cost.

Dedicated API Gateways

From open banking API concept design to go-live, implement and manage APIs, with financial-grade performance for results. All done centrally with zero disruption to your existing systems.

Rich API Library

Blinq’s ready-to-use Financial-Grade APIs (FAPIs) library (AIS, PIS etc.) gives the highest levels of security all while eradicating resource waste, enabling businesses to expand footprint while staying agile.

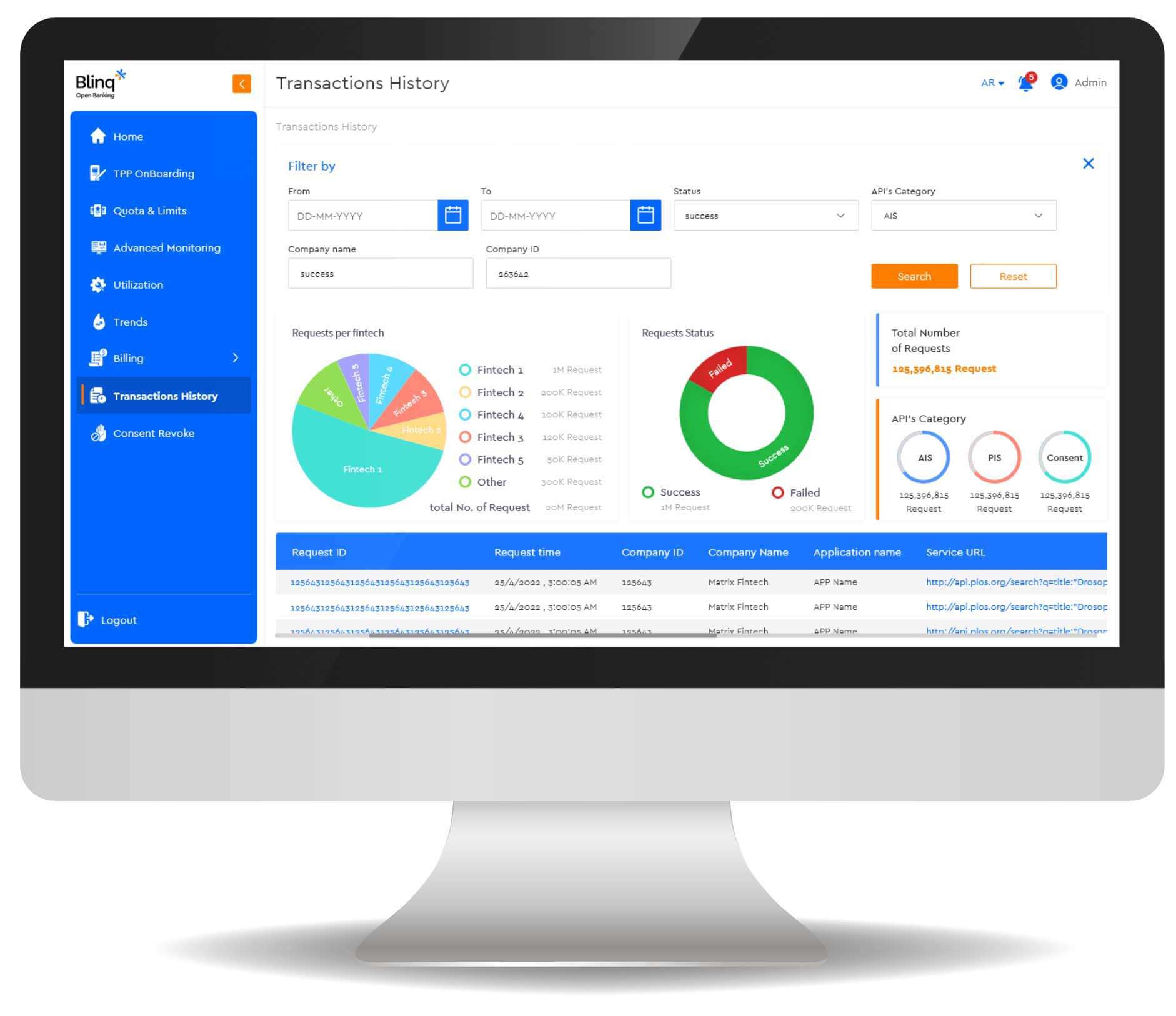

Insights & Reporting

User-friendly insights portal from service usage to regulatory mandated reporting, Blinq covers a wide spectrum of internal and external reporting needs with data-driven decisions.

Billing Engine

Blinq’s monetization scheme builder is there to simplify billing and charging complexity. With No-code user interface, administrators can create charging schemes, invoice them, and track revenues and payments, all while being integrable with a variety of systems automating invoicing and collection workflow.

Command Center

End-to-end administration suite for real-time monitoring, management and orchestration for internal processes. Available to expose external partners automating +50% of integrations tasks.

Why Blinq Open Banking?

FAPI OpenID Certified

Highest security and performance standards.

Maximize Revenue & Growth

One-stop-shop to dominate untapped markets and monetize APIs.

Landing Running

Seamless Interoperability between Blinq and variety of systems for frictionless experience.

Scalability

Micro-services platform can scale according to your business needs, on the go.

Regulatory Compliance Guaranteed

All our products are compliant with regulators’ cybersecurity, data and frameworks.

Simply Effective

With No-code administration, go-to-market is easy.

More About Product

Leveraging the latest technologies and our years of experience, KnowledgeNet builds innovative products and services that serve the financial sector and banking institutions. To get a summarized glimpse on our product, check out our KnowledgeNet Hub.